Managing your finances can be complex. But with the right tools, it becomes easier and more efficient.

Financial planning tools help you stay on top of your money. They assist in budgeting, tracking expenses, and planning for future goals. Whether you’re managing personal finances or running a business, these tools offer clarity and control. With them, you can automate tasks, reduce errors, and save time. In this post, we will explore some of the best financial planning tools available. These tools will help you make informed decisions, streamline your financial operations, and ensure you stay compliant with regulations. For startups, an all-in-one tool like Firstbase can simplify many processes. From incorporation to tax filing, it covers everything. Let’s dive into the world of financial planning tools and see how they can transform your financial management.

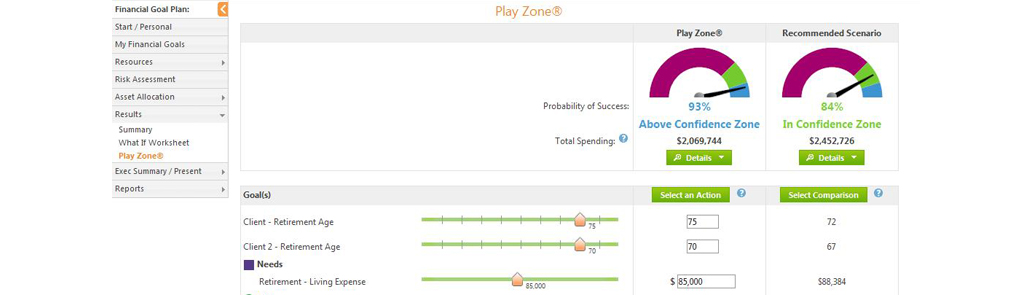

Credit: www.schwab.com

Introduction To Financial Planning Tools

Financial planning tools are essential for both individuals and businesses. They help manage finances efficiently, ensuring long-term stability and growth. These tools provide insights into budgeting, saving, investing, and managing expenses. Let’s explore what financial planning tools are and their importance.

What Are Financial Planning Tools?

Financial planning tools are software or applications designed to help manage and organize financial activities. These tools can range from simple budgeting apps to comprehensive financial management platforms like Firstbase One.

Key features of financial planning tools include:

- Budgeting and expense tracking

- Investment management

- Tax planning and filing

- Debt management

- Financial goal setting

Firstbase One, for instance, offers an all-in-one startup operating system. It simplifies incorporation, compliance, bookkeeping, and taxes for businesses. This makes it easier for founders to manage their financial planning without legal headaches.

The Importance Of Financial Planning

Effective financial planning is crucial for several reasons:

- Stability: Proper financial planning ensures you have enough funds to meet your short-term and long-term goals.

- Growth: It helps in identifying investment opportunities that can grow your wealth over time.

- Risk Management: Planning helps in preparing for unforeseen expenses and financial emergencies.

- Compliance: Tools like Firstbase One ensure that businesses comply with state and federal regulations, preventing legal issues.

For businesses, using an integrated tool like Firstbase One can save time and money. It consolidates multiple processes such as incorporation, accounting, tax filing, and payroll registration in a single platform. This automation ensures faster and more accurate financial management.

In conclusion, adopting financial planning tools can significantly enhance your financial health and business operations.

Credit: www.asset-map.com

Key Features Of Effective Financial Planning Tools

Financial planning tools are essential for managing finances efficiently. They help individuals and businesses track expenses, manage investments, set financial goals, forecast future finances, and ensure data security. Below are the key features that make these tools effective.

Effective financial planning tools offer comprehensive budgeting and expense tracking. Users can categorize expenses, set budget limits, and monitor spending in real-time. These tools often include features like:

- Automated transaction categorization

- Spending alerts and reminders

- Customizable budget categories

By keeping a close eye on spending, users can ensure they stay within their financial limits.

Managing an investment portfolio can be complex. Financial planning tools simplify this by providing detailed insights and analytics. Key features include:

- Real-time portfolio tracking

- Performance analysis

- Risk assessment

Users can make informed decisions and optimize their investment strategies.

Setting financial goals is crucial for long-term success. Effective tools allow users to set goals and track their progress. Features often include:

- Custom goal creation

- Visual progress tracking

- Automated reminders

This helps users stay motivated and focused on their financial objectives.

Forecasting future financial scenarios is essential for planning. Financial tools provide robust forecasting and reporting features such as:

- Income and expense projections

- Scenario analysis

- Detailed financial reports

These features enable users to anticipate challenges and make strategic decisions.

Security and data privacy are paramount in financial planning. Effective tools ensure that user data is protected with:

- Encryption and secure data storage

- Two-factor authentication

- Regular security audits

Users can trust that their sensitive information is safe and secure.

For an all-in-one solution, consider Firstbase One. It simplifies incorporation, compliance, bookkeeping, and taxes. Visit Firstbase for more details.

Budgeting And Expense Tracking

Managing your finances can be challenging without the right tools. Effective budgeting and expense tracking are essential for maintaining financial health. Using tools specifically designed for these tasks can simplify the process and help you achieve your financial goals.

How Budgeting Tools Help Manage Finances

Budgeting tools provide an organized way to track income and expenses. They help you see where your money goes each month.

Here are some key benefits of budgeting tools:

- Automated Tracking: Automatically track all your expenses and categorize them.

- Real-time Updates: Get real-time updates on your spending and saving progress.

- Goal Setting: Set and monitor financial goals, such as saving for a vacation or paying off debt.

These features make it easier to stay on top of your finances and avoid unnecessary spending.

Solving Overspending And Undersaving Issues

Overspending and undersaving are common problems that can derail financial stability. Budgeting tools can help address these issues effectively.

| Problem | Solution |

|---|---|

| Overspending | Create spending limits and receive alerts when you approach them. |

| Undersaving | Set automatic savings transfers to ensure consistent saving. |

By addressing these issues, you can improve your financial health over time.

The Importance Of Tracking Expenses

Tracking expenses is crucial for understanding your spending habits. It helps identify areas where you can cut back and save more.

Consider these benefits of tracking expenses:

- Identifying Trends: Spot patterns in your spending and adjust accordingly.

- Reducing Waste: Eliminate unnecessary expenses and allocate funds to more important areas.

- Improving Savings: Increase your savings by being more mindful of your spending.

Regularly tracking your expenses helps maintain control over your finances and supports better decision-making.

Investment Portfolio Management

Investment portfolio management is crucial for maximizing returns and mitigating risks. It involves selecting and overseeing a collection of investments tailored to meet financial goals. Effective management can make a significant difference in achieving these objectives.

Features For Managing Investments

Investment management tools offer various features to streamline the process:

- Performance Tracking: Monitor the performance of individual assets and the entire portfolio.

- Asset Allocation: Diversify investments across different asset classes to reduce risk.

- Risk Analysis: Evaluate and manage the risk associated with different investments.

- Tax Optimization: Minimize tax liabilities through strategic investment decisions.

- Custom Reporting: Generate detailed reports to analyze portfolio performance over time.

Benefits Of Automated Portfolio Rebalancing

Automated portfolio rebalancing brings several advantages:

- Consistency: Ensures your portfolio remains aligned with your investment strategy.

- Time-Saving: Reduces the time spent manually adjusting your portfolio.

- Emotion-Free Investing: Avoids emotional decision-making by following a predetermined plan.

- Cost Efficiency: Lowers transaction costs by reducing the frequency of trades.

Solving The Complexity Of Diverse Investments

Diverse investments can complicate portfolio management. Tools like Firstbase One can simplify this process:

| Feature | Description |

|---|---|

| Incorporation | Automate formation of LLC or C-Corp with ease. |

| Mailroom | Manage all business mail in one place. |

| Agent | Ensure compliance with registered agent services. |

| Accounting | Access a powerful platform for full-service bookkeeping. |

| Tax Filing | Easily file state and federal taxes. |

| Banking | Get approved for a US bank account quickly. |

By leveraging these features, investors can manage diverse investments more efficiently and effectively.

Goal Setting And Progress Tracking

Financial planning tools can transform your approach to managing money. They provide ways to set clear financial goals and track progress. This ensures you stay on course and make informed decisions. Let’s explore how these tools help in goal setting and progress tracking.

Defining Financial Goals With The Tools

Setting financial goals is the first step towards financial success. Tools like Firstbase One simplify this process. You can define goals for incorporation, compliance, bookkeeping, and taxes. The tool automates these tasks, making goal-setting easier.

Here’s how you can use Firstbase One:

- Incorporation: Automate the formation of LLC or C-Corp.

- Mailroom: Manage business mail with a premium US address.

- Accounting: Access full-service accrual bookkeeping.

- Tax Filing: File state and federal taxes easily.

Tracking Progress Towards Achieving Goals

Once you set your goals, tracking progress is crucial. Financial planning tools offer features to monitor your journey. For example, Firstbase One provides:

- Agent Services: Ensure compliance with registered agent services.

- Equity Management: Create a captable in Carta and file 83(B) for free.

- Banking: Quickly get approved for a US bank account.

These features help you keep an eye on your progress and make adjustments as needed.

How Goal Tracking Motivates Better Financial Habits

Tracking your progress can motivate you to adopt better financial habits. Seeing your achievements encourages you to stay disciplined. Here’s why it works:

- Visual Progress: Tools show your progress in real-time.

- Accountability: Regular updates keep you accountable.

- Informed Decisions: Data insights help you make better choices.

Firstbase One helps you stay focused and motivated. It provides real-time updates and insights, ensuring you develop healthier financial habits.

Financial Forecasting And Reporting

Financial forecasting and reporting are essential components of effective financial planning. They provide insights into future financial scenarios, the value of detailed financial reports, and the importance of making informed decisions based on forecasts.

Predicting Future Financial Scenarios

Forecasting helps predict future financial scenarios by analyzing past data and market trends. This process enables businesses to plan for potential opportunities and challenges. Tools like Firstbase One offer comprehensive solutions to simplify this process. They automate the formation of LLC or C-Corp, ensuring compliance and seamless incorporation.

With reliable data, businesses can create accurate financial models. These models project revenue, expenses, and cash flow. This prediction helps in setting realistic goals and preparing for financial uncertainties.

The Value Of Detailed Financial Reports

Detailed financial reports provide a clear picture of a company’s financial health. They include income statements, balance sheets, and cash flow statements. These reports are crucial for stakeholders, investors, and decision-makers. They offer insights into profit margins, liabilities, and overall financial performance.

Firstbase One simplifies the creation of these reports through its powerful accounting platform. It offers full-service accrual bookkeeping and timely financial closures. This ensures that businesses have accurate and up-to-date financial data at their fingertips.

Making Informed Decisions Based On Forecasts

Informed decision-making is key to a company’s success. Financial forecasts provide the data needed to make strategic decisions. These decisions include budget allocation, investment planning, and risk management.

Using tools like Firstbase One, businesses can automate payroll tax registration and manage withholding and unemployment accounts. This streamlines operations and reduces the risk of errors. Additionally, the platform’s banking marketplace helps businesses get approved for a US bank account quickly, facilitating smooth financial transactions.

Accurate forecasts and detailed reports empower businesses to make informed decisions. They help in identifying growth opportunities and mitigating risks, ensuring long-term success and stability.

Security And Data Privacy

Ensuring the security and privacy of financial data is crucial for any business. Using financial planning tools like Firstbase One, companies can safeguard their sensitive information effectively. Below, we delve into the importance of protecting financial data, key security features to look for, and how tools ensure data privacy.

Importance Of Protecting Financial Data

Financial data is one of the most sensitive types of information a business handles. Unauthorized access can lead to severe consequences, including financial losses and reputational damage. Protecting this data is essential to maintain trust with stakeholders and ensure compliance with regulatory requirements.

Firstbase One places a high priority on data security. By utilizing robust security measures, businesses can prevent breaches and protect their financial integrity.

Key Security Features To Look For

When selecting a financial planning tool, certain security features are vital:

- Encryption: Ensures that data is unreadable to unauthorized users.

- Two-Factor Authentication (2FA): Adds an extra layer of security by requiring two forms of identification.

- Regular Security Audits: Helps identify and fix vulnerabilities.

- Secure User Access Controls: Limits access based on user roles and permissions.

Firstbase One incorporates these features to provide a secure environment for managing financial data.

How Tools Ensure Data Privacy

Financial planning tools like Firstbase One deploy various methods to ensure data privacy:

- Data Anonymization: Sensitive information is anonymized to protect user identity.

- Compliance with Regulations: Adhering to GDPR, CCPA, and other privacy laws.

- Secure Data Storage: Data is stored in secure servers with restricted access.

- Clear Privacy Policies: Transparent policies on how data is collected, used, and shared.

Firstbase One ensures that all user data is handled in accordance with the highest privacy standards, giving users peace of mind.

Pricing And Affordability Of Financial Planning Tools

Financial planning tools like Firstbase One offer a range of features to streamline business operations. Understanding the pricing and affordability of these tools is crucial for startups and small businesses. This section will break down pricing models, evaluate costs versus benefits, and explore affordable options for different budgets.

Breakdown Of Pricing Models

Firstbase One provides a comprehensive package designed to simplify business management. The pricing model for Firstbase One is straightforward:

| Package | Features | Price |

|---|---|---|

| Firstbase One |

| Save $1,950 |

The all-in-one package consolidates multiple tools, offering significant savings compared to purchasing services separately.

Evaluating Cost Vs. Benefits

When choosing a financial planning tool, it’s essential to weigh the costs against the benefits. Firstbase One provides:

- Automation of business processes, saving time and reducing errors.

- Global support, making it suitable for international founders.

- Access to $350,000 in perks from partners.

These benefits can lead to substantial savings and improved operational efficiency. For startups, the initial investment in a tool like Firstbase One can pay off through streamlined processes and reduced administrative burdens.

Affordable Options For Different Budgets

Firstbase One offers an all-in-one package that provides extensive features. For businesses with tighter budgets, it might be useful to explore other financial planning tools that cater to specific needs:

- Basic Incorporation Services: Suitable for startups focusing on the initial setup.

- Standalone Accounting Software: For businesses that need robust bookkeeping without additional services.

- Tax Filing Services: Ideal for small businesses looking for help with state and federal taxes.

By selecting tools based on immediate needs, businesses can manage costs while still gaining access to essential services.

Explore the comprehensive solutions and pricing at Firstbase to find the best fit for your business.

Pros And Cons Based On Real-world Usage

Financial planning tools, like Firstbase One, offer numerous benefits but also come with some limitations. Understanding these can help in making informed decisions.

Advantages Of Using Financial Planning Tools

Using financial planning tools can significantly streamline business operations. Below are some of the key advantages:

- Automation: Tools like Firstbase One automate incorporation, compliance, bookkeeping, and taxes, reducing the need for manual intervention.

- All-in-One Platform: Consolidate multiple tools into one platform, saving both time and money.

- Global Support: Trusted by founders in 188 countries, offering support from real humans.

- Perks and Rewards: Access to $350,000 in perks from partners and integrations.

- Legal Support: Access up to $6,000 worth of credits from top law firms.

These advantages can make financial management more efficient and less stressful for business owners.

Common Drawbacks And Limitations

Despite the numerous benefits, financial planning tools can also have some drawbacks:

- Cost: The initial investment for comprehensive tools like Firstbase One may be high for small startups.

- Complexity: Some users may find the platform overwhelming due to its extensive features.

- Limited Refund Policies: No specific refund or return policies are mentioned, which might be a concern for some users.

- Learning Curve: New users might need time to understand and use all the features effectively.

These limitations should be considered when selecting a financial planning tool.

User Reviews And Testimonials

User feedback is crucial in assessing the effectiveness of financial planning tools. Here are some testimonials from Firstbase One users:

| User | Review |

|---|---|

| Jane Doe | “Firstbase One made incorporation and compliance a breeze. Highly recommended for startups!” |

| John Smith | “The automation features saved us a lot of time and reduced errors. Great tool for bookkeeping.” |

| Emily Johnson | “The platform is packed with features, but it took some time to get used to. Worth the effort though.” |

| Michael Brown | “The lack of a clear refund policy was a bit concerning, but the support team was helpful.” |

These reviews highlight the real-world experiences of users, showcasing both the strengths and areas for improvement of financial planning tools like Firstbase One.

Recommendations For Ideal Users And Scenarios

Financial planning tools are designed to help users manage their finances more efficiently. Whether you’re just starting or have advanced needs, different tools cater to various user levels and scenarios. Here’s a breakdown to help you choose the best option for your needs.

Best Tools For Beginners

For beginners, simplicity and ease of use are crucial. Tools like Firstbase One are ideal as they provide an all-in-one platform that simplifies incorporation, compliance, bookkeeping, and taxes. This means new users can manage their finances without dealing with complicated processes.

- Incorporation: Automate forming an LLC or C-Corp without legal headaches.

- Mailroom: Manage all business mail with a premium, physical US address.

- Accounting: Access an accounting platform for full-service bookkeeping.

- Tax Filing: Easily file state and federal taxes for LLCs or C-Corps.

Ideal Solutions For Advanced Users

Advanced users often require more robust features. Firstbase One caters to these needs with additional functionalities:

- Agent: Ensure compliance with registered agent services and annual reports.

- Payroll Tax Registration: Manage payroll taxes and withholding accounts across all states.

- Banking: Get approved for a US bank account quickly.

- Equity: Create a captable in Carta and file 83(B) for free.

Scenarios Where Financial Planning Tools Excel

Financial planning tools excel in various scenarios, providing unique benefits:

| Scenario | Benefit |

|---|---|

| Startups | Automate incorporation and compliance, saving time and resources. |

| Global Support | Trusted by founders in 188 countries with real human support. |

| Tax Filing | File state and federal taxes easily, reducing errors. |

| Accounting | Full-service bookkeeping ensures accurate financial records. |

Choosing the right tool is essential for effective financial management. Whether you’re a beginner or an advanced user, there’s a tool that fits your needs perfectly.

Credit: www.lowewealthadvisors.com

Frequently Asked Questions

What Are Financial Planning Tools?

Financial planning tools are software or applications. They help in managing your finances. They assist in budgeting, saving, and investing.

Why Use Financial Planning Tools?

Using financial planning tools simplifies managing finances. They provide insights and recommendations. They help achieve financial goals efficiently.

How Do Financial Planning Tools Work?

Financial planning tools analyze your income and expenses. They create budgets and track spending. They offer investment advice and savings plans.

Can Financial Planning Tools Improve Budgeting?

Yes, financial planning tools can improve budgeting. They categorize expenses and monitor spending. They highlight areas to save money.

Conclusion

Financial planning tools are essential for effective money management. They simplify complex tasks. Firstbase One is a comprehensive solution for startups. It automates incorporation, bookkeeping, and taxes. This all-in-one platform saves time and money. Trusted by founders globally, it offers real human support. Interested in exploring more? Check out Firstbase for a seamless financial planning experience.